CDB in Action

Disrupt

Leveraging technology, CDB disrupts traditional time-based financial practices and enables the direct delivery of solutions to customers’ doorsteps, even in remote rural areas.

Accelerating digital transformation

CDB has successfully embraced digital transformation to adapt to the rapidly evolving digital landscape, ensuring its long-term success and growth in the digital era. The process of digital transformation was built upon four key pillars.

The first pillar, the process transformation, involved reimagining, re-engineering and optimising existing workflows by incorporating digital technologies. This included automating manual tasks, streamlining operations, and leveraging data analytics to drive efficiency and productivity.

The second pillar, being the business model transformation, focused on identifying new revenue streams, exploring innovative business models, and capitalising on emerging digital trends. By doing so, CDB aimed to create value and remain competitive in the market.

The third pillar, domain transformation, involved expanding into new markets enabled by digital technologies. CDB achieved this by offering new products and services, entering strategic partnerships, and utilising digital platforms to reach a broader customer base.

The fourth pillar, being the cultural/organisational transformation, revolved around fostering a digital-first mindset within the Organisation. This was accomplished by nurturing a culture of innovation, promoting collaboration, and empowering team members to effectively embrace and leverage digital tools.

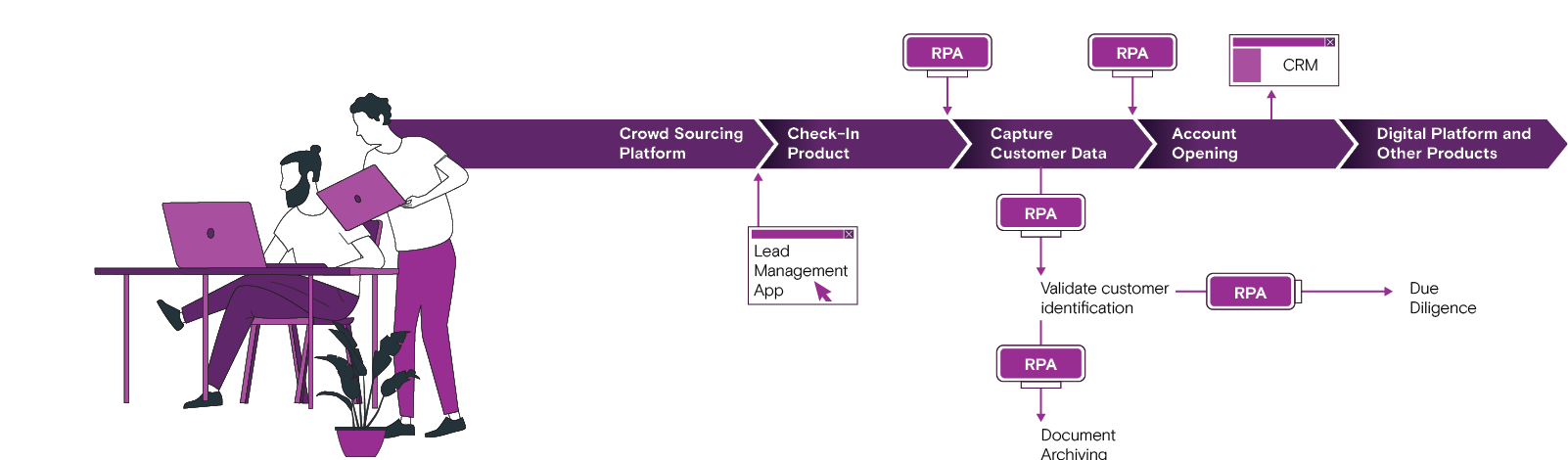

A significant outcome of this transformation was CDB’s digital customer acquisition strategy, which was based on a thorough understanding of its customers. To attract customers, CDB utilised crowd-sourcing platforms and efficiently manage the leads generated through these platforms using its affinity sales force mobile application. This ensured that all leads were promptly addressed, fulfilling the promises made to customers.

CDB also implemented a comprehensive approach to enhance customer engagement through various channels, including digital service platforms, mobile apps, social media, live chat, phone, email, self-service tools, and personalised notifications. By doing so, the Company improved customer convenience, accessibility, and satisfaction. While CDB embraced technology, it also valued face-to-face interactions and maintained engagement through branches and relationship managers.

Despite not opening physical branches in the past five years, CDB successfully expanded its reach solely through virtual operations. This exemplified the Company’s value proposition of “Tech with a touch”, which emphasised people-enabled technology. Overall, CDB’s digital transformation efforts have resulted in better alignment with evolving customer needs, higher conversion rates, improved customer satisfaction, and a competitive edge in customer acquisition.

Approximately 50,000 customers, representing 15% of the total customer base, have embraced its digital self-service channels, such as the CDB iNet App and CDB iControl App. In the year 2022/23 alone, CDB witnessed over 12,000 new registrations on these platforms. Additionally, the Company successfully digitally onboarded over twenty three thousand clients and facilitated more than fourteen thousand savings account openings through its efficient RPA technology. Moreover, the Customer Due Diligence (CDD) processes conducted, ensured data privacy and compliance with all necessary regulations, while welcoming new and existing customers based on transaction criteria.

https://www.amptiva.com/cx-financial

Digital onboarding and account opening statistics

- Average credit cards request per month - 367

- Average credit file requests per month - 1,808

- Client creation for FY 2022/23 RPA - 23,103

Manual - 8,777 - Savings accounts openings for

FY 2022/23

RPA - 14,933 - iNet customers onboarded for

FY 2022/23 - 3,410 - Number of iDeposits placed - 6,018

Value of iDeposits placed - Rs. 1,457 Mn. - iNet app downloads - 43,963

iControl app downloads - 6,789 - CDB website visitors - 505,605

- CDB Facebook followers - 104,037

- CDB LinkedIn followers - 8,343

Digitalising customers’ loan journey

CDB aims to provide its customers with a fully digital experience right at their doorstep, prioritising their convenience. To facilitate the digitalisation of the customer journey and expedite the decision-making process, CDB has developed a comprehensive and integrated ERP system. In addition, the Customer Due Diligence (CDD) process has been automated with the help of Robotic Process Automation (RPA) which ensures timely verification and compliance with regulatory requirements.

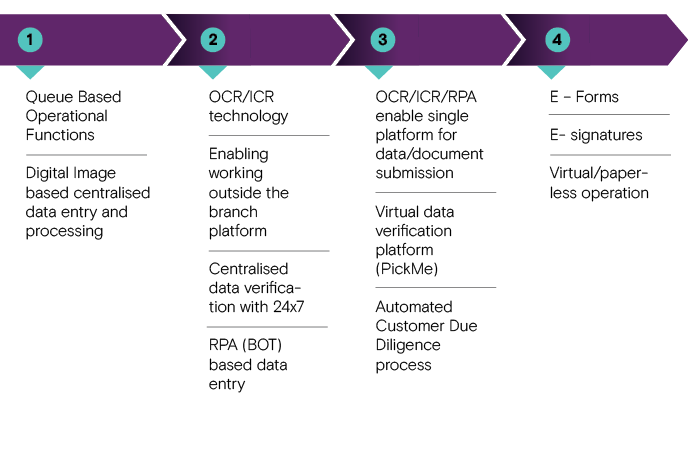

The customer onboarding process has been simplified and made more efficient through the CDB Flexi Capture App given to the field-based marketing staff. This facilitates mobile phone-enabled document submission and Robotic Process Automation (RPA) integrated with data entry through the Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) options in fulfilling the onboarding cycle.

Additionally, the automation of the process of granting credit facilities to customers has resulted in increased customer acquisition capacity and mobility, enabling field officers to work independently while bypassing the branches they are attached to. It has also helped in reducing the credit process lead time significantly from approximately four days to just one day. The end-to-end automation includes customer onboarding, savings account opening, debit and credit card submission and approvals, Application Programming Interface (API) based CRIB report downloads, credit file submission through CDB Flexi Capture App, Enterprise Resource Planning (ERP) based credit facility approval and delivery of digital delivery order to the customer in real-time.

Successful digitalisation of a customer’s loan journey, and embedding it into operational processes, provides a competitive advantage in an environment where customers have a variety of choices in obtaining a loan. The digitalisation of the customer’s loan journey entails implementing an online application process, enabling digital document submission and verification, automating loan decisions, and providing digital updates to customers. This end-to-end digitalisation enhances convenience, reduces paperwork, and expedites the loan journey for customers.

CDB was the first to successfully implement end-to-end lending process automation, which involved the implementation of digital tools, software, and workflows to automate tasks to minimise manual intervention has resulted in reduced turnaround times, enhanced operational efficiency, lower costs, improved risk management, a better customer experience and compliance. Furthermore, in providing oversight, a cross-functional team comprising business operations, information technology, compliance, risk, and credit evaluation was deployed to provide oversight of the process.

The Automated Lending Process introduced during the year enabled CDB to win the award for Process Automation, clinching the “Most Innovative Global Business Service/BPM”, awarded by the Sri Lanka Association for Software Services Companies (SLASSCOM).

Automated credit decisions

To enhance convenience for its customers, CDB has developed capabilities that enables it to complete the entire credit granting process from client acquisition to the final payment to the supplier. This includes the use of OCR/ICR technologies, Robotic Process Automations, API CRIB scoring, its proprietary credit scoring mechanism, and the issuance of digital supply agreements.

Automated credit decisions streamline and expedite the credit evaluation process, leading to faster loan approvals. By leveraging technology such as data analytics and scoring models, automated systems provide efficient and accurate assessments, reducing manual errors, improving risk management, and enhancing customer experience.

CDB has implemented a three-tier automated credit decision system, classifying credit decisions as “Green”, “Yellow”, and “Red” with “Yellow” based on the creditworthiness of customers with “Green” denoting the highest creditworthiness and “Red” denoting the lowest credit worthiness.

In FY 2022/23, from the total automated credit decision granted facilities of 3,844 with a disbursed value of Rs.2.028 Bn, 95.68% of the facilities granted through automated credit decision accounting for Rs. 1.915 Bn. fell under the “Green” category.

The “Yellow” category comprised 4.32% of the total with 166 facilities and Rs. 112.9 Mn.

The combined data in the automated credit decision section comprised a total of 3,844 facilities, with a disbursed amount of Rs. 2,028 Mn. representing 100% of the total.

To empower its team members and enhance customer convenience, CDB has authorised them to issue debit/credit cards. This enables customers to enjoy financial freedom and control.

Automation of post-disbursement follow-up

Automation of post-disbursement follow-up of credit ensures timely and effective management of loan repayments. By automating tasks such as payment reminders, payment follow up and monitoring, restructuring processes, and settlement procedures, it minimises human error, improves efficiency, and enhances customer satisfaction by facilitating smooth communication and helping clients fulfil their financial commitments.

This includes the integration of online payment systems such as CEFT and SLIPs, as well as partnerships with major banks in the country to facilitate customer payments through their branches and CRMs, collaborations with the largest retail supermarket to provide customers with ease in fulfilling their repayment commitments by enabling them ample access to timely repayment opportunities.

The Company’s post disbursement follow-up mechanism incorporates data analytics tools such as Tableau to ensure optimal utilisation of resources and enable proactive decision-making.

Furthermore, an automation was done using the Debt Collection Monitoring Application built through our own ERP solution known as "Smart Collect" which enabled remote work through smart devices integrated to automated Recovery Call Management System, "Iphonik". These technologies aim to boost efficiency and enhance post-monitoring of credit facilities. Furthermore, CDB has implemented automated processes for facility restructuring and settlement to efficiently deliver required services to clients.

Automation for enhanced efficiency

By embracing automation, financial services organisations gain several benefits including enhanced operational efficiency by reducing manual tasks, and streamlined key processes resulting in faster and more accurate transactions. It minimises human error and improves data integrity, leading to better risk management while also enabling cost savings through reduced labour and improved productivity. Moreover, automation enhances the customer experience by enabling self-service options and faster response times, ultimately driving customer satisfaction and strengthening customer relations. Since automation generally leads to paperless operations, it also adds to the organisation’s sustainability credentials.

During the year under review, CDB carried out several key automation processes, resulting in increased operational efficiency, reduced manual errors, streamlined workflows, faster transaction processing, improved customer service, enhanced data accuracy, cost savings through reduced staff utilisation and paper usage, and compliance with regulatory requirements. These processes include:

- The e-Statement for savings accounts eliminates the passbook and related requirements, resulting in reduced paper wastage.

- The Digital app offers a fully automated Customer Due Diligence (CDD) process, in line with the Financial Intelligence Unit (FIU) guidelines of the CBSL. CDB was among the first institutions to implement such an automated platform for CDD. Moreover, the app offers internal memo automation, eliminating the need for paper for memos. Submissions and approvals are carried out digitally through the system leading to paper savings and enabling automated archival for future reference.

- Exception report development ensures compliance with regulatory requirements, data accuracy, better management decisions and customer service. It also enables better record keeping and monitoring as well as safer and sustainable historical record storing.

- An automated deposit renewal queue provides the ability to accommodate changes in customers’ renewal conditions. Requests can be made without obtaining new mandates, and the system includes built-in deposit rate approval.

- Removing unnecessary letters: Manual letters have been converted into emails/SMS.

- ERP-based client and account creation forms eliminate the need for Flexi capture and reduce paper usage.

- ERP-based credit application creation eliminates the need for Flexi capture and reduces paper usage.

- The ERP Queue-based supplier payment process speeds up the release of supplier payments with automated controls and minimises data entry.

- Data analytics and business intelligence helps to obtain valuable insights and actionable information to make strategic and tactical decisions to drive growth and maintaining a competitive edge in the market.

- Digital forms for onboarding has significantly reduced paper usage and enabled a contactless onboarding process, eliminating the need for direct customer-staff interactions. This has promoted self-service and empowered customers to conveniently complete necessary procedures independently.

- E-pay Slip enables employees to access and view their payee details as and when they need while reducing the usage of paper.

Going Virtual - CDB’s technology vision and journey

CDB embarked on a transformative journey, embracing virtualisation, and revolutionising operations across a substantial number of its departments and processes. With a vision to enhance customer experience and embrace technological advancements, the Company set out to create a seamless virtual financial services environment.

The first step was the development of robust online platforms and user-friendly mobile applications, laying the foundation for the virtual journey. As customers embraced these digital offerings and channels, CDB expanded its services, enabling online account openings, effortless fund transfers, convenient bill payments, and streamlined loan applications. The Company prioritised security and reliability, ensuring customers could trust and rely on their virtual journey and experience.

Through continuous innovation and investment in cutting-edge technology, CDB has successfully transitioned into a virtual powerhouse, empowering customers to access financial services anytime, anywhere. This journey has not only improved customer convenience, but has also streamlined operations, reduced costs, and positioned CDB as a leader in the virtual financial services landscape.

Strengthening customer due diligence (CDD)

CDB places significant importance on implementing robust Customer Due Diligence (CDD) processes by ensuring thorough customer identification, collection, and verification of crucial information. This is followed by meticulous risk assessments to evaluate customers’ profiles based on factors such as their business activities, transaction patterns, and potential exposure to politically exposed persons (PEPs).

Moreover, CDB places great emphasis on determining the source of funds to guarantee their legitimacy and legality, thereby preventing any involvement with illicit activities, and carrying out enhanced due diligence (EDD) for higher-risk customers. Strong emphasis is placed on ongoing monitoring of customer accounts and transactions to promptly identify any suspicious or unusual activities, using a combination of automated systems and manual review processes.

To ensure compliance with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, CDB regularly updates its protocols and procedures to align with evolving regulatory requirements. The Company steadfastly reports any suspicious transactions to the appropriate regulatory authorities as mandated by the regulations.