CDB in Action

Our vision for the next decade is to transform into a Quarter Trillion Asset Base (Q-TAB) Company by leveraging two key pillars: Tech Disruption and Sustainability Agenda that encompasses both social and environmental dimensions.

Our Business and Context

Surveying our operating context

Understanding and adapting to the operating environment is crucial to navigate challenges, seize opportunities, comply with regulations, meet customer needs, and maintain long-term sustainability in an ever-evolving financial landscape.

The operating environment of a financial institution is a complex ecosystem comprising various factors and players. The political environment, global financial trends and economic stability, social and market conditions, technological advances, the prevailing legal framework, and various other factors influence the environment. This, in turn, shapes the institution’s strategic decisions, risk management practices, customer interactions, and competitive landscape.

Trust, transparency, and effective risk management strategies are vital for maintaining customer confidence and ensuring the smooth functioning of its operations. Compliance with stringent regulatory frameworks, security measures, and privacy policies is essential. In addition, technological advancements drive digital transformation, offering customers convenience, accessibility, and personalised services.

Political - Sri Lanka’s efforts to address economic crisis with IMF support

In March 2022, the Government of Sri Lanka sought assistance from the International Monetary Fund (IMF) to address the economic crisis that occurred in 2022. Approval was obtained for a 48-month extended arrangement under the IMF’s Extended Fund Facility (EFF) totalling almost USD 3 billion. One of the key objectives within this arrangement is to restructure public debt and achieve debt sustainability, which is essential for long-term economic growth and stability.

The Government and the Central Bank of Sri Lanka (CBSL) have already implemented policy measures and reforms that have yielded positive results. Inflation, which had reached a historic peak in September 2022, has now returned to a favourable disinflation trend. The exchange rate, after experiencing a significant depreciation in the first half of 2022, has stabilised and even appreciated in early 2023. Additionally, the external current account deficit has remained modest, and official reserves have gradually increased. As a result, the country was able to reintroduce exchange rate flexibility in March 2023.

Looking ahead, it is crucial to execute consistent and well-coordinated policies, as outlined in the IMF-EFF supported programme, to prevent future crises. Normalising foreign exchange flows, completing the debt restructuring process, and implementing comprehensive reforms in the public sector are expected to contribute to improved and sustainable economic prospects for Sri Lanka.

By prioritising data-driven decision-making and avoiding ad hoc policy experiments, the government can mitigate the negative consequences of populist policies and ensure the welfare of the general public and businesses.

Economic - Unprecedented challenges and signs of economic recovery

Global economy

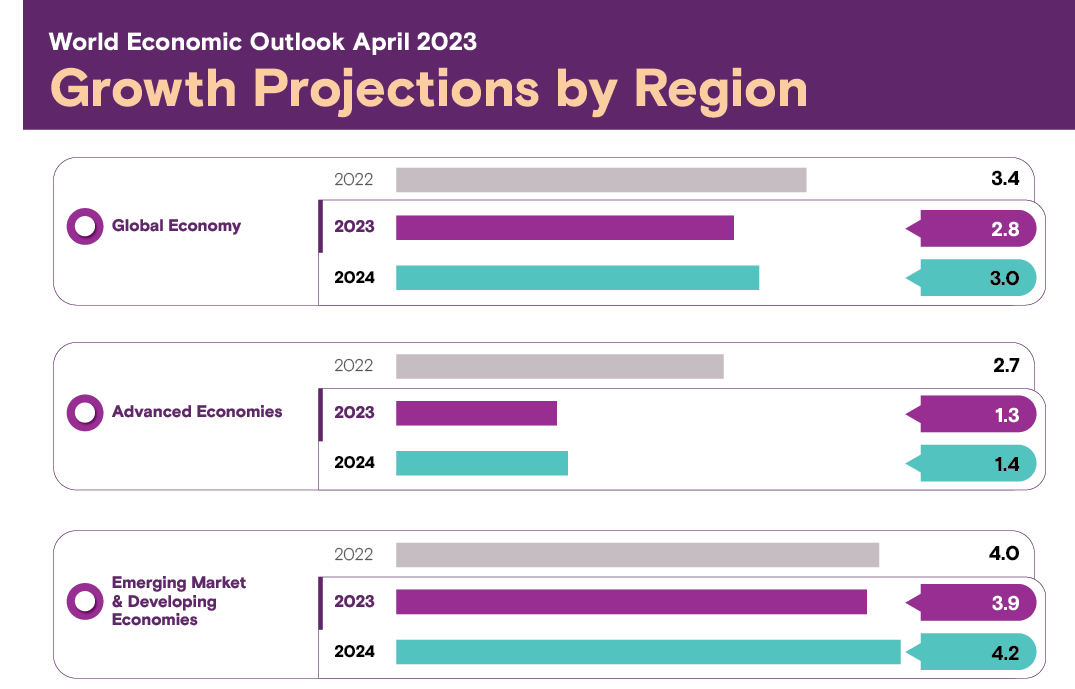

The global economy faces a challenging path to recovery, according to the International Monetary Fund (IMF). Growth is projected to decline from 3.4% in 2022 to 2.8% in 2023, with a subsequent stabilisation at 3.0% in 2024. Advanced economies are expected to experience a significant slowdown in growth, dropping from 2.7% in 2022 to 1.3% in 2023. In the baseline scenario, global headline inflation is anticipated to decrease from 8.7% in 2022 to 7.0% in 2023. However, achieving the target inflation rate is unlikely before 2025. The situation across Asia and developing economies indicates positive growth, headed by China and India. Overall, the next few years appear to be uncertain due to turbulence in the financial sector, elevated inflation, persistent repercussions from Russia’s invasion of Ukraine, and the enduring impact of three years of the COVID-19 pandemic.

World Economic Outlook April 2023

Growth Projections by Region

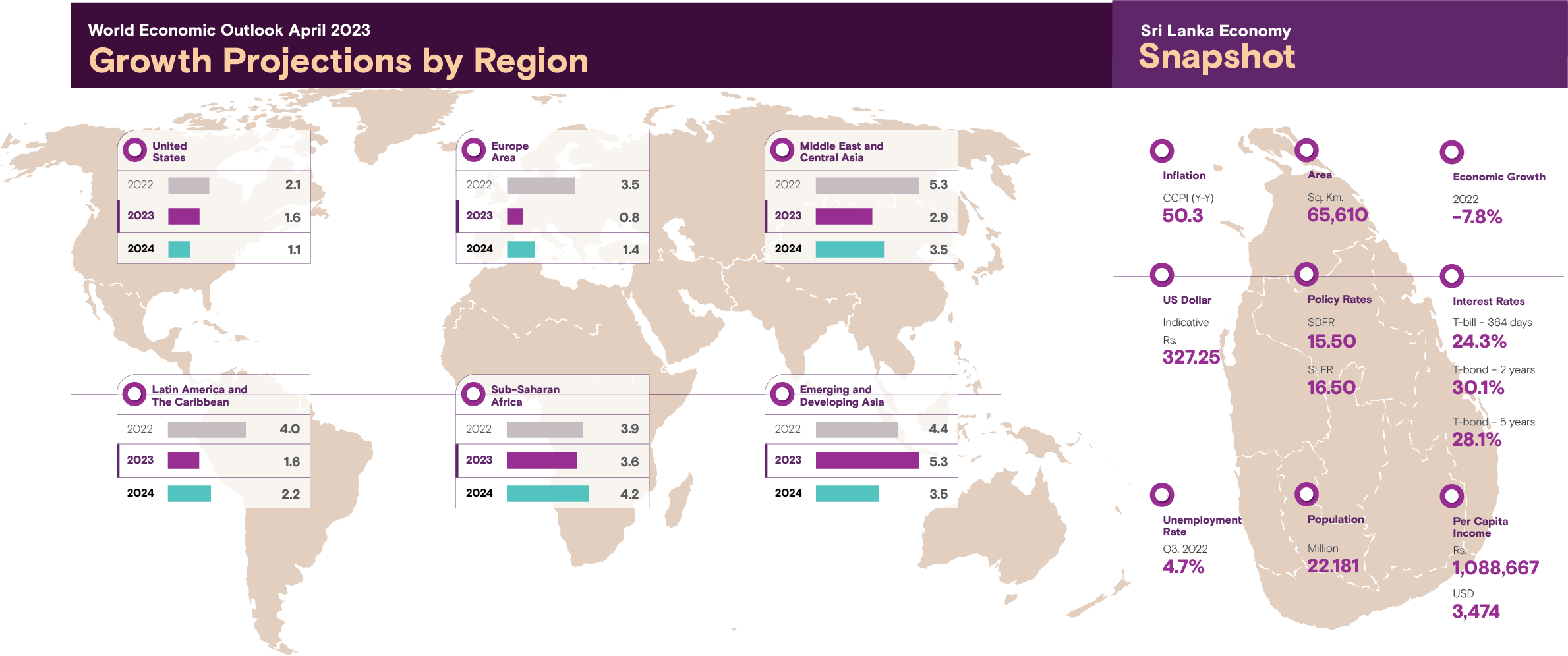

World Economic Outlook April 2023

Growth Projections by Region

Sri Lanka Economy

Snapshot

The Central Bank of Sri Lanka reports a 7.8% contraction in the economy in 2022. Additionally, the per capita income declined to USD 3,474, resulting in the country once again being classified as a lower middle-income nation.

The outlook for Sri Lanka appears highly concerning, as per the IMF’s projections, with an anticipated decline of 2% in 2023, followed by a modest growth of 3.3% in 2024. However, the IMF is of the view that the macroeconomic situation in Sri Lanka is showing tentative signs of improvement, with inflation moderating, the exchange rate stabilising, and the Central Bank rebuilding reserves buffers.

In nominal terms, the Sri Lankan economy experienced a significant increase of 37.2% in 2022 compared to 12.3% in the previous year, indicating a high inflation rate. However, when considering the US dollar value, the overall size of the economy shrank to USD 77.1 Bn. in 2022 from USD 88.5 Bn. in 2021 due to a substantial depreciation of the exchange rate. The per capita GDP also decreased to USD 3,474 in 2022 from USD 3,997 in 2021. Analysing the expenditure approach, consumption expenditure, which accounted for 69.2% of the GDP, grew by 34.3% in 2022, a significant increase compared to 8.4% in 2021, contributing significantly to the overall growth of the economy. This growth was mainly driven by a sharp increase in inflation, with household consumption expenditure growing at a higher rate of 39.0% in 2022 compared to 9.4% in the previous year. Additionally, government consumption expenditure increased by 3.8% in 2022, compared to 2.3% in 2021.

However, as the year progressed, the economy began showing gradual signs of recovery, with improvements in export earnings, inward remittances and tourism. Imports too were reduced owing to the high exchange rates, leading to less pressure on the balance of payment situation.

The Non-Bank Finance sector

Despite challenges faced from shrinking credit growth, declining profitability, and the increase in non-performing loans as indicated by Stage 3 loans, the NBFI sector grew in terms of assets and deposits with adequate capital and liquidity buffers during 2022. The asset base of the sector expanded by 3% and stood at Rs. 1,635 Bn. by end March 2023, compared to the 14% growth recorded in March 2021.

During 2022, debt moratoria and concessions on loan repayments were extended to assist affected borrowers of the NBFI sector due to the prevailing extraordinary macroeconomic conditions.

The Masterplan for consolidation of NBFI (the Masterplan) is implemented with the objective of establishing strong and stable LFCs in the medium term and thereby safeguarding the interest of depositors of the sector and preserving the financial system stability.

Future outlook

The IMF programme is expected to trigger additional financing assistance with budget support from the World Bank and the Asian Development Bank of USD 3.75 Bn., of which USD 900 Mn. is expected in 2023. It is also expected that with the recovery in the economy and building of reserve buffers, Sri Lanka would be able to access international markets to raise funds in terms of sovereign bond issues in the future.

Foreign exchange earnings are likely to receive a boost as Sri Lanka Tourism has set an ambitious target of 1.5 million arrivals and an income of USD 5 Bn. by attracting high-end travellers who spend more on a broader range of activities.

Meanwhile, Sri Lanka has been listed on the Forbes magazine as one of the 23 best places to visit in 2023, providing an added incentive for potential travellers.

Currently, the Government of Sri Lanka shoulders the financial burden of 420 government institutions and enterprises. Among the major 52 State-Owned Enterprises (SOEs), there is an annual loss amounting to Rs. 86 Bn. In an effort to address this situation, the government plans to restructure certain SOEs, including many leading institutions. The proceeds generated from these entities will be utilised to bolster the country’s foreign exchange reserves.

Given the above positive developments, the Sri Lankan economy is likely to post a reasonable performance overcoming the adverse predictions. This is likely to have a positive impact on the performance and growth of CDB in the coming year.

Social - Navigating demographic changes and workforce challenges

The demographic landscape in Sri Lanka is experiencing profound transformations, propelled by factors including economic, social, and political concerns, digital transformation, health dynamics, and skill shortages. This ongoing transformation presents significant challenges for organisations as they strive to reimagine their business models and effectively manage their workforce. To navigate these challenges successfully, adaptability, strategic workforce management, and addressing the needs of different generations will be crucial.

Sri Lanka, a developing country, is experiencing a notable demographic shift characterised by an increase in its elderly population. It currently has the highest proportion of elderly people in Southeast Asia, a trend expected to continue in the future. This presents specific challenges due to the country’s lower economic growth rates compared to developed nations.

In 2022, there was a substantial rise in the number of Sri Lankans leaving the country for foreign employment, particularly skilled and unskilled labourers and housemaids. This phenomenon can be attributed to the country’s ongoing economic, social, and political crises.

The global shift in work patterns, driven by ongoing uncertainty and unprecedented circumstances, has had a profound impact on the human capital agenda of organisations, particularly in the financial services sector. Technological advancements have reduced headcount through intelligent automation and created a demand for technology skills. Financial institutions face intensified competition from technology companies in recruiting and retaining critical talent.

In uncertain and challenging operating environment, business operations have had to adapt to meet customer expectations while prioritising employee well-being and productivity. However, within this context, generational differences in work expectations and shifting demographics can result in higher turnover.

Technological - The digital transformation of financial institutions and cybersecurity concerns

The world is undergoing a digital transformation, and financial institutions are at the forefront of this change. They have embraced digitalisation in various aspects of banking, leading to new opportunities and enhanced customer experiences. The COVID-19 pandemic further accelerated the adoption of digital technologies to overcome the limitations of reduced mobility.

Digitalisation in financial services involves leveraging mobile technology, fintech partnerships, cloud computing, big data, advanced analytics, machine learning, blockchain, AI, robotics, and biometrics. These technologies optimise existing IT infrastructure and open up new revenue channels. Financial institutions are increasingly collaborating with fintech companies to deliver innovative solutions at a faster pace. Virtual video conferencing and remote collaboration tools have also transformed the manner in which businesses operate and how people interact with technology.

Sri Lanka, in particular, has experienced a rapid acceleration in mobile phone penetration, which has facilitated the growth of digital transactions. The improvements in mobile services have contributed to increased productivity and efficiency in financial transactions.

However, alongside the positive aspects of the digital revolution, there is also a dark side that cannot be ignored. One of the most concerning issues is the significant increase in financial crime and cyberattacks which has become more frequent, intense, and sophisticated. Financial institutions are primary targets for cyberattacks due to their involvement in payment systems and possession of sensitive customer information. These attacks are aimed to gain access, alter, or destroy valuable data, extort money, or disrupt banking services.

Consumer and employee behaviour is continually evolving in the digital world, with technology enabling seamless and secure connections across multiple devices. Financial institutions need to adapt to these trends and meet evolving customer demands. Investment in new products and capabilities is necessary to deliver convenient banking and provide access to financial solutions.

Environmental - Addressing climate risks and promoting sustainable finance

Sri Lanka, as a small island nation, faces significant vulnerability to the adverse effects of climate change, including extreme weather events and natural disasters that impact various economic sectors and livelihoods. The country’s financial sector is also exposed to climate-related risks and needs to urgently address these risks to mitigate potential financial and reputational losses. By making responsible investment choices and ensuring transparent reporting, financial institutions can contribute to the transition to a sustainable economy and support climate mitigation and adaptation initiatives.

Financial institutions are under growing pressure from both regulators and the market to safeguard themselves against the impact of climate change and align with global sustainability goals. This involves implementing new rules for managing climate risks, conducting stress tests, and integrating environmental, social, and governance (ESG) factors into investment decisions.

The financial sector plays a crucial role in shaping future economies, as its capital allocation decisions can either accelerate or hinder the transition to a sustainable economy. To fulfil this role responsibly, financial institutions need to reduce investments in environmentally harmful industries, increase sustainable finance initiatives, divest from fossil fuels, and make responsible investment decisions. Many financial service institutions have committed to achieving net-zero emissions and pledged to provide funding for climate mitigation, adaptation solutions, and sustainable development.

Legal - Promoting responsible financial services and enhancing data privacy

Regulatory bodies are enacting new rules and regulations to promote responsible financial solutions, maintain global stability, and safeguard customers and financial institutions from the impact of increased competition, technological advancements, and disruptive business models. These regulations are taking into account various factors such as public access to financial products, financial stability, consumer protection, digital transformation, cybersecurity, climate change, payments, diversity and inclusion, and regulations specific to the financial sector. Regulators are adopting a collaborative approach by engaging with industry bodies and stakeholders to develop regulations that keep pace with the rapid changes brought about by digital advancements. Recent initiatives indicate that regulators will continue to monitor the conduct of financial institutions and impose further requirements on digital management in the medium to long term.

In 2022, the regulatory landscape in Sri Lanka focused on updating existing laws to align with recent developments in the financial sector. Amendments were introduced to the Foreign Exchange Act, Finance Business Act, Finance Leasing Act, and Payment and Settlement Systems Act. Sri Lankan financial institutions have introduced digital services such as online banking and payment gateways, but the country’s digital laws are still in the early stages of formation.

Data privacy has become increasingly important in recent years due to political, social, and ethical factors. Many countries, including Sri Lanka, have been actively drafting data protection laws. Sri Lanka passed the Personal Data Protection Act (PDPA), No. 9 Of 2022, which aims to protect individuals’ rights and ensure consumer trust in information privacy in online transactions and information networks resulting from the growth and innovation of the digital economy. Additionally, a draft Cybersecurity Bill is being finalised under the National Cyber Security Strategy (2019-2023) to establish a comprehensive framework for preventing and managing cybersecurity threats and protecting critical information infrastructure.