CDB in Action

Impact

As Sri Lanka advances towards a socio-economic revival, CDB, as a pioneer in technology-infused and sustainability-driven strategies, aligns seamlessly with the nation’s positive momentum.

Towards a 1 million customer base

Our business model and strategy reflect our aspiration of becoming a Quarter Trillion Asset Base (Q-TAB) Company within the current decade (2021-2030), driven by our commitment to sustainability and embracing technological disruption as the key enablers. This is in perfect alignment with Sri Lanka’s socio-economic revival, and our technology-infused, sustainability-driven strategy seamlessly aligns with the nation’s positive momentum. A crucial element is our disruptive approach to technology, positioning CDB as a formidable "David Vs Goliath" competitor challenging large incumbents.

Catering to changing needs of customers throughout their life cycle

Understanding customers’ life cycles is of utmost importance for a financial services organisation. It involves analysing the stages a customer goes through, from initial contact to acquisition, and retention. By having a thorough understanding of this cycle, organisations can tailor their marketing strategies, personalise customer interactions, enhance customer experiences, and maximise customer lifetime value. It helps organisations to identify opportunities for cross-selling, upselling, and customer loyalty programmes, leading to increased customer satisfaction, repeat business, and long-term profitability.

CDB is dedicated to meeting customers’ evolving needs by offering tailored financial products and services, supporting their goals at every life stage. We strive to make luxury affordable, amplify aspirations, and elevate lifestyles. We begin with minors’ savings for children and students. Young professionals benefit from personal loans and credit cards. Families and homeowners can access home loans, savings, and investment options. Business owners and entrepreneurs have access to business loans, gold loan services, specialised accounts, and investment services. Our comprehensive range of offerings ensures that individuals and businesses receive the necessary support to thrive and achieve financial success at every step.

Furthermore, CDB is making affordable roof solar systems accessible to customers, which not only presents business opportunities but also reduces carbon emissions and decreases reliance on imported fuels, taking advantage of Sri Lanka’s abundance of over 300 sunny days annually.

Minor

CDB Ranketi Savings

Young Adults

CDB Aspire Lease

CDB Real Saver

CDB Salary Plus

CDB Credit Card

CDB iDeposit

CDB iTransfer

CDB Personal Loan

Adults

CDB Platinum Saver

CDB Dhanasurekum FD

CDB Ran Naya

CDB Cash Lease

CDB Credit Card

CDB Business Loans

CDB Home Loans

CDB Personal Loan

CDB Margin Trading

CDB Advance Roof Solar

CDB Fast Cash

CDB Money Exchange

Senior

CDB Deegayu Savings

CDB Margin Trading

CDB Deegayu FD

Our product portfolio

Our conventional and check-in product portfolio

Check-in products

Core products

Core products

Other services

Enhancing customer experience: Delivering delight and satisfaction

A positive customer experience holds immense value for an organisation, as it cultivates customer loyalty, fuels positive word-of-mouth referrals, enhances brand reputation, boosts revenues, and mitigates the risk of negative feedback. By fostering growth, differentiation, and long-term success, organisations can capitalise on the power of customer satisfaction. Investing in exceptional customer experiences becomes a strategic imperative in today’s competitive landscape which in turn drives sustainable business outcomes and foster meaningful customer relationships.

In this context, CDB remains highly focused on leveraging its customer-centric approach to reach a customer base of 1 million by focusing on personalised experiences and tailored services. CDB has invested in customer relationship management systems, backed by emerging technologies, to gather comprehensive data on customer preferences and behaviours. It also emphasises proactive communication, actively seeking feedback and addressing customer concerns promptly.

CDB prioritises the creation of a positive and delightful customer experience by emphasising various aspects of its services that meet multiple facets of customers’ lives, ensuring personalised and efficient customer support, as well as offering multiple channels for assistance. This is backed by user-friendly and intuitive digital-based offerings and apps which offer a seamless experience, allowing customers to easily access and manage their accounts online or through mobile applications. This initiative also relates to its endeavour to ‘Disrupt’ the industry through state-of-the-art digital offerings as detailed in the ‘Disrupt’ section of the Annual Report.

Our strategy revolves around elevation of aspirations of our customers by making luxury affordable. Our purpose "Empowering Aspirations" enhances and engrave our philosophy into our business strategy and business conduct.

We focus on providing solutions to customer needs via digital platforms which enables them to transact at their convenience. As discussed in the disrupt pillar, we have inbuilt and use digital technology into our processes to ensure speed service to our clients. We place greater emphasis on providing secured platforms to our clients which enables customers transact at ease.

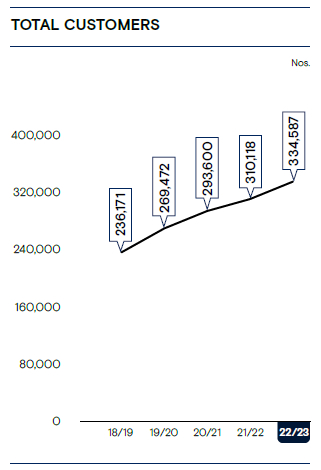

CDB is well on its way to achieving its goal of having a customer base of one million, as evidenced by the addition of 54,454 customers during 2022/23, reflecting a 31.21% YoY increase. The inclusion of several new customer-related initiatives could add further impetus to our customer acquisition drive.

Additionally, the Company emphasises timely and transparent communication, keeping customers informed about any updates, promotions, or changes to their products or services. Seeking customer feedback regularly CDB demonstrates its commitment to continuously improving the overall customer experience. Notably, these initiatives are rooted in digital innovations, which perfectly align with the needs of the younger customers and support the Company’s sustainability agenda. Through digital solutions, CDB minimises paper usage and needless travel for both customers and the team members.

Strengthening customer loyalty and retention

CDB prioritises customer loyalty by implementing various strategies that create a positive and personalised experience. Personalised communication is achieved through a dedicated priority line for Premier customers, making them feel valued and strengthening their connection to the brand. Loyalty programmes offer exclusive benefits and complementary gifts to reward and show gratitude to loyal customers. Feedback channels are established using contactless QR methods, demonstrating responsiveness and a commitment to improving services.

Exclusive benefits, such as waived fees, are extended to loyal customers to incentivise continued engagement. Exceptional customer service is emphasised through comprehensive training, ensuring prompt resolution of inquiries and issues. Building personal relationships is a focus, achieved by using customers’ names and integrating systems for enhanced personalisation.

To further reinforce loyalty, each Premier Elite and Premier customer is assigned a dedicated account manager who provides personalised attention and conducts tailored visits.

These comprehensive strategies aim to cultivate and nurture stronger customer loyalty, maintain long-term relationships, and ensure that every customer touchpoint with CDB is met with appreciation and value. By prioritising satisfaction, trust, and a strong bond with customers, CDB strives to create a customer-centric environment that fosters loyalty and ongoing engagement.

Engaging marketing initiatives: campaigns, promotions, and communications

GRI 416-1, 417-1

Customer attraction is important for customer acquisition as it drives initial interest and engagement with a company’s products or services. By effectively attracting potential customers through compelling marketing campaigns, appealing offers, and a strong brand presence, businesses can generate leads and initiate the acquisition process. Attraction serves as the initial step in acquiring customers, creating opportunities to showcase the company’s value proposition, and convert prospects into loyal customers, ultimately contributing to business growth and profitability.

In this regard, marketing campaigns, promotions, and marketing communications help create brand awareness, promote products and services, and attract new customers. Effective campaigns and promotions drive customer engagement, generate leads, and increase conversions. Marketing communications build trust, educate customers, and communicate value propositions. These strategies differentiate the organisation from competitors, foster customer loyalty, and contribute to revenue growth and long-term success in the competitive financial services industry.

CDB has strategically leveraged social media for its targeting effectiveness and also the capability to target the selected audience more precisely. The Company’s social media strategy is built upon a platform-driven content approach, encompassing three strategic pillars. Firstly, influencer-based marketing expands the reach and enhances campaign impact. Secondly, a product-driven content strategy creates innovative and audience-centric content to enhance engagement. Lastly, customer engagement is prioritised through activities including competitions, to actively involve the audience and strengthen relationships.

Given below are key Marketing Campaigns Launched in FY 2022/23:

- Gold loan: Campaign using ATL, BTL, and TTL, focusing on confidentiality, security, interest rate, and higher loan advance. It was positioned as ”රන්තරන් ණය දෙන ඉස්තරම් තැන”, with the value proposition as ”පළමු මස පොළියෙන් භාගයක් ආපසු” with the extension of ”පළමු දින 10ට පොළී නෑ” We launched this new campaign in August 2022, on-boarded more than 6,000 new customers, and achieved Rs. 1.6 Bn. net business volume for a month, which was the highest-ever in CDB’s gold loan history.

- i-deposit (Digital Fixed Deposit): Focused on the digital fixed deposit feature of the CDB’s digital financial platform, through the Instagram and Facebook campaign, “Be Smart and Stay Safe” to encourage people to open digital deposits with just Rs. 5,000. This campaign was aimed to encourage youth to save for their future, in a hassle-free manner using their mobile phone or any other smart device.

The Company upholds transparent and ethical marketing practices, providing comprehensive product and service information in English, Sinhala, and Tamil languages. The digital marketing efforts have yielded positive results including expanded reach, increased web traffic, and greater awareness of its offerings. Successful campaigns promoting CDB Advance Roof Solar and the digital fixed deposit feature of CDB iNet have effectively encouraged sustainable living and youth savings. Leveraging platforms like Instagram and Facebook, these campaigns strategically target specific demographics aligning with their lifestyles and preferences.

Reaching out to customers through multiple touchpoints

Expanding customer touch points offers several benefits for an organisation such as enhancing customer convenience by providing multiple channels for transactions, communication and interaction. This leads to increased customer satisfaction and loyalty. It improves accessibility, allowing organisations to reach a wider audience and engage with customers across different platforms, which fosters faster resolution of issues and personalised support, resulting in enhanced customer experience. Expanding touchpoints also enables organisations to gather valuable customer data and insights, facilitating targeted marketing strategies and informed decision-making.

CDB has adopted a multichannel approach to delivering financial services, offering diverse customer engagement platforms, including mobile platforms, digital solutions, contact centre, branches, and Relationship Managers. In recent years, especially during and after the pandemic, witnessed a notable shift towards digital channels and services. This transformation is driven by consumer and business preferences, fuelled by the surge in online commerce, contactless payments, and digital cash transfers. Younger customers belonging to Gen X, Gen Y and Gen Z also exhibit a preference for such channels, in keeping with their lifestyles and aspirations. CDB’s migration to digital channels demonstrates its commitment to meeting evolving customer needs and preferences prioritising accessibility, convenience, and safety in financial transactions. The Company’s “Tech with a touch,” approach exemplifies its transition towards technology that enhances and empowers individuals.

Our technological capabilities enable us to reach out to the most remote, rural, and vulnerable base of the pyramid markets supporting CDB to be a net lender to the rural economy and providing access to finance, leading to financial inclusion. Due to the technology-based approach, CDB has not opened a single physical outlet during the last five years, whilst more than doubling our business capacity.

Reaping the best rewards from our brand equity

Improving brand equity is crucial as it establishes the reputation and perceived value of a brand, which in turn enhances customer loyalty, trust, and preference, resulting in increased market share and competitive advantage. It helps CDB to attract new customers, encourages continued interaction, and supports the attraction of high net-worth customers. Additionally, strong brand equity generates positive word-of-mouth, fosters brand extensions, and provides resilience during market fluctuations. Ultimately, improving brand equity contributes to the long-term success and profitability of the Company.

The brand strategy at CDB is centred around positioning itself as an innovative and sustainable brand within the financial services industry. The Company strives to disrupt traditional norms by offering technologically advanced and environmentally sustainable product and service solutions while prioritising financial inclusion and making a positive impact on the community. CDB’s overarching brand intent is to “Empower a smart and sustainable Sri Lanka”. This commitment to empowering aspirations has earned recognition, as the Company was ranked among the Ten Best Corporate Citizens for 2022, a recognition that has been garnered for the fifth consecutive year. The Ten Best Corporate Citizens are selected from a wide range of corporate stewards in Sri Lanka by an independent panel of judges and evaluators in the Best Corporate Citizen Sustainability Award organised by the Ceylon Chamber of Commerce. CDB consistently enhance its brand equity by embodying its core values of perseverance, empathy, reliability, and innovation in every customer interaction.

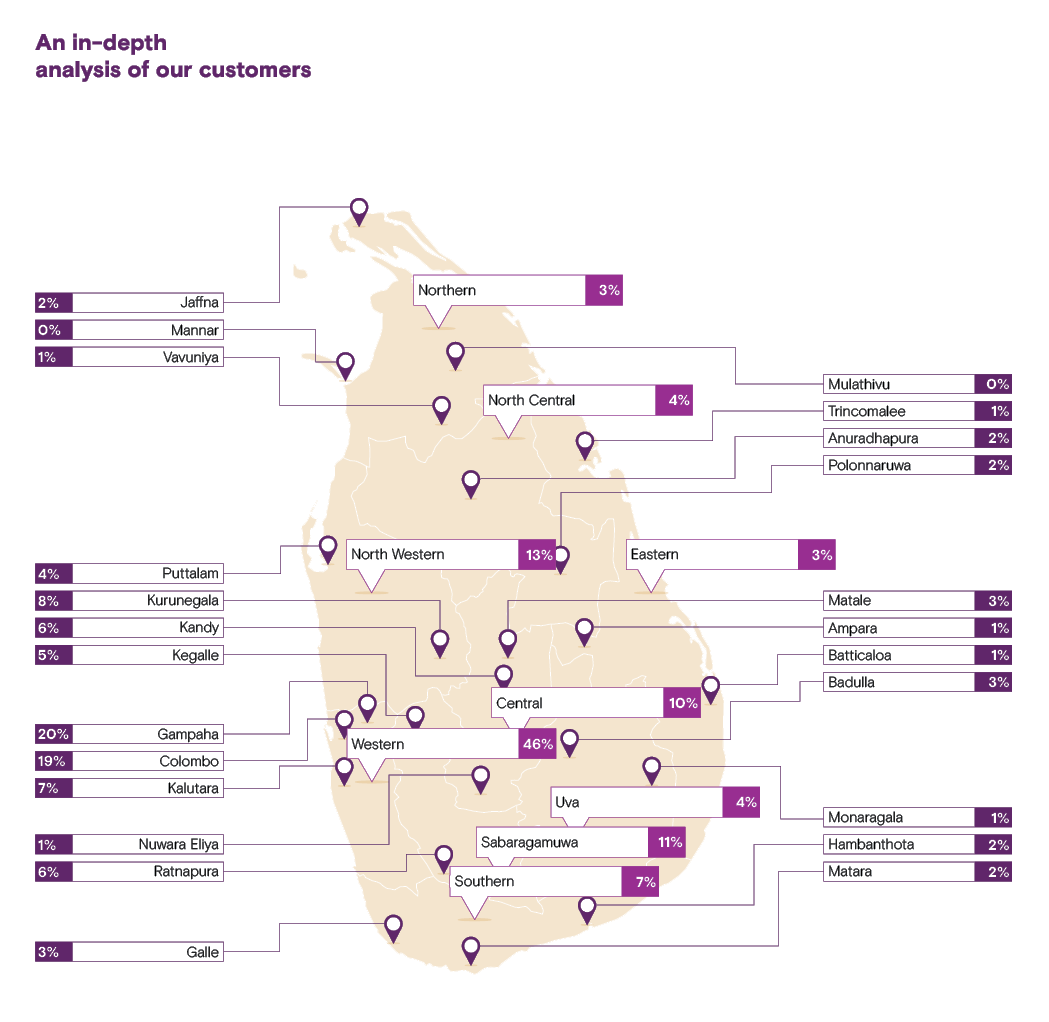

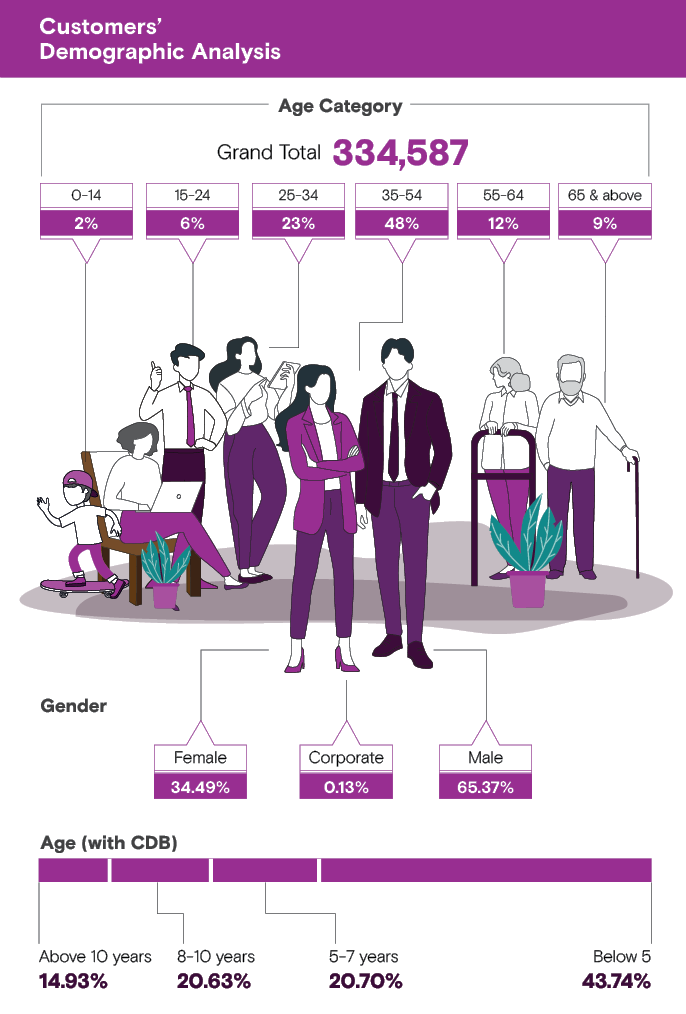

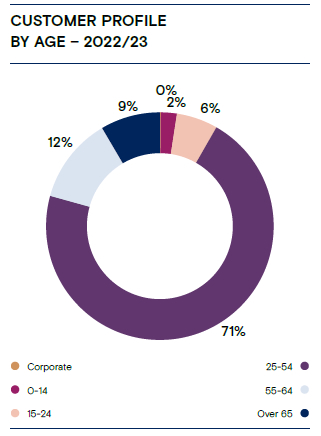

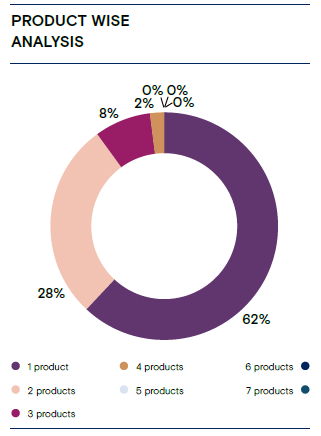

An in-depth analysis of customers

Conducting an in-depth analysis of customers is of paramount importance, as it allows organisations to gain a comprehensive understanding of their target audience, their preferences, behaviours, and needs. This analysis helps CDB to develop effective marketing strategies, offer personalised products, and deliver exceptional customer experiences. By uncovering valuable insights, CDB is able to make data-driven decisions, optimise its resource allocation, and enhance customer satisfaction, which enables it to stay ahead of the competition, build long-term relationships, and drive sustainable growth.

Given below is an analysis of various customer segments at CDB:

Customer profile by region

| Province | 2022/23 % | 2021/22 % | 2020/21 % | 2019/20 % | 2018/19 % | 2017/18 % |

| Western | 46.34 | 46.52 | 46.52 | 47.20 | 48.09 | 48.03 |

| North Western | 12.81 | 12.70 | 12.79 | 12.82 | 12.62 | 12.55 |

| Sabaragamuwa | 10.95 | 10.82 | 11.04 | 10.44 | 10.27 | 10.29 |

| Central | 9.78 | 9.55 | 9.68 | 9.50 | 9.58 | 9.63 |

| Southern | 6.66 | 6.70 | 6.65 | 6.51 | 6.25 | 6.25 |

| North Central | 3.91 | 4.02 | 4.07 | 4.11 | 4.07 | 4.15 |

| Uva | 3.92 | 3.91 | 3.45 | 3.58 | 3.40 | 3.46 |

| North | 2.84 | 2.85 | 2.97 | 3.15 | 3.12 | 3.11 |

| Eastern | 2.79 | 2.91 | 2.82 | 2.70 | 2.59 | 2.52 |

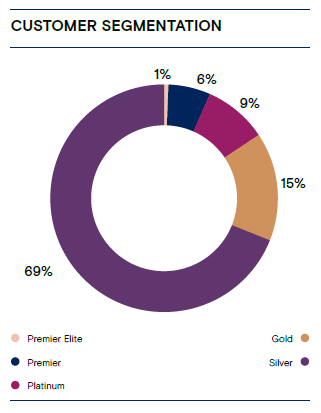

Customer segmentation for effective targeting of customers

Customer segmentation is important because it allows organisations to understand and target specific groups of customers with tailored marketing strategies. By dividing a diverse customer base into distinct segments based on characteristics such as demographics, behaviours, needs, or preferences, organisations can customise their offerings, messaging, and experiences to resonate with each segment. This personalised approach increases the effectiveness of marketing efforts, improves customer satisfaction, enhances customer retention, and maximises overall business performance by delivering relevant solutions that meet specific customer needs.

Customer segmentation enables CDB to carry out targeted marketing, allowing the creation of tailored campaigns for specific customer segments. Customised product development enhances customer satisfaction by meeting unique needs. Efficient resource allocation focuses efforts on high-value segments, optimising costs. Risk management identifies and mitigates risks by understanding segment-specific profiles. Cross-selling and upselling opportunities arise from understanding customer preferences. These benefits improve customer satisfaction, operational efficiency, and profitability.

Customer segmentation at CDB is solely based on the customer’s portfolio. Segments include Premier Elite, Premier, Platinum, Gold, and Silver.

Customer Lifetime Value (CLV) plays a crucial role in customer identification and provides a comprehensive analysis of the standard segmentation method described earlier. CLV is determined through an extensive evaluation that considers factors such as portfolio size, payment regularity, age, terminated facilities, number of facilities, number of previous facilities, deposit value, and deposit period. Based on this refined analysis, customers are categorised into five distinct segments: According to CLV analysis, customers are categorised in to five distinct groups as A,B,C,D and E. When executing customer engagement and loyalty initiatives, particular attention will be given to the A and B categorised customers.

| Segment | % |

| Premier Elite | 1 |

| Premier | 6 |

| Platinum | 9 |

| Gold | 15 |

| Silver | 69 |

Identifying customers with the greatest future potential

CDB assesses the future potential of customers through a combination of data-driven analysis and customer segmentation techniques. By leveraging customer data, including purchase history, behaviour and transaction patterns, as well as demographic information, the Company identifies high-potential customers. Additionally, CDB analyses customer interactions, engagement levels, and feedback to gauge their likelihood of becoming long-term, profitable customers. Furthermore, CDB conducts market research to identify emerging trends and customer needs, allowing the Company to tailor its products, services, and marketing strategies to attract and retain customers with high future potential.

Customers constantly move ahead in life, elevating their lifestyles and aspirations over time. CDB serves customers based on their future potential through tailored financial solutions, relationship building, education, proactive communication, innovation and technology, and strategic partnerships. The Company offers customised products and assigns dedicated Account Managers to meet the evolving needs of customers, offering them added prestige and recognition. Furthermore, CDB provides education and support to enhance financial literacy and decision-making capabilities. Proactive communication keeps CDB connected and responsive to changing requirements. Embracing innovation and technology enables the delivery of advanced solutions, while strategic partnerships expand the range of offerings. By adopting these strategies, CDB supports customers’ growth and helps them achieve their future goals.

Maximising the efficiency of our call centre

GRI 418-1

An efficient call centre is crucial as it serves as a key point of contact with customers, in addition to reducing the time and effort required for direct contact, as well as crowding at branches. It ensures timely and effective customer support, resolution of issues, and dissemination of information. A well-functioning call centre enhances customer satisfaction, builds trust, and strengthens brand loyalty. It provides a platform for personalised interactions, in addition to addressing customer inquiries and concerns promptly. Moreover, an efficient call centre helps gather valuable customer feedback and data, enabling organisations to identify trends, improve processes, and enhance the overall customer experience.

CDB’s Call Centre serves as a vital customer service hub, providing assistance and resolving queries efficiently on a trilingual 24x7 basis. Customers can reach the Call Centre through a designated phone line, where a team of trained professionals offers personalised support, handling various inquiries, such as account-related questions, product information, transaction assistance, and issue resolution. The Call Centre agents possess comprehensive knowledge of the Company’s offerings and procedures, allowing them to provide accurate and timely assistance to customers. By leveraging technology and effective communication skills, the Call Centre ensures a positive customer experience, fostering satisfaction, and building long-term relationships. During the year, several enhancements were carried out to improve the customer experience.

Missed call service

Customers are able to inquire about the arrears of lending facilities and billing information of credit cards through a simple missed call. Customers have 24/7 access to this service with no hold time and no interaction with contact center agents.

Objectives

- Reducing call traffic

- Providing more convenience to customer

- Reducing the traffic in other touch points

- Reducing physical customer visits

Analysis of Missed Call Service Usage

| Month | Credit Card | Lending |

| November 2022 | 5,155 | 6,487 |

| December 2022 | 8,577 | 3,480 |

| January 2023 | 5,618 | 5,349 |

| February 2023 | 7,276 | 3,679 |

| March 2023 | 9,229 | 6,796 |

Priority queue

In 2018, CDB introduced a dedicated hotline number (0117678200) for premier customers, ensuring priority access. Through an API-based system, customers calling from their registered number are directed to the dedicated hotline. This initiative aims to provide customised and efficient service. Internal Service Level Agreements (SLAs) monitor and maintain high customer experience standards, including reduced queue time and timely resolution of inquiries. Contact Center team members receive specialised training to handle premier customers.

OUR CALL CENTRE STATISTICS FOR 2022/23

| Total Offered Calls | |

| Total | 262,816 |

| Sinhala | 236,657 |

| English | 9,523 |

| Tamil | 16,636 |

| Answered Calls | |

| Total | 248,117 |

| Sinhala | 224,495 |

| English | 8,713 |

| Tamil | 14,909 |

| Answered within Threshold | |

| Total | 215,327 |

| Sinhala | 196,938 |

| English | 7,096 |

| Tamil | 11,293 |

| Sinhala | English | Tamil | Total | |

| SLA (KPI – 85%) | 83.46 | 74.98 | 68.19 | 82.19 |

| Answered (%) | 95 | 92 | 90 | 95 |

| Abandoned (%) (KPI – 5%) | 5.08 | 8.39 | 10.32 | 5.53 |

| Average handling time | 03:27 | 03:59 | 03:22 | 03.36 |

Mystery customer survey

The mystery customer market research technique is adopted to evaluate customer service, quality, and consistency extended by the front office, call centre and marketing team members across the branch network. This qualitative research approach involves conducting observations and tracking evaluations for each branch. Individual team member performance is assessed based on criteria such as customer care, selling skills, knowledge, and interpersonal skills, etc. Additionally, Company performance is evaluated based on factors like facilities, documentation, branch ambience, and overall aspects of CDB.

Throughout the year, three separate mystery surveys were conducted at all branches, the contact centre, and the patpat.lk platform. The results were promptly updated to an online dashboard within 24 hours, facilitating employee education, training, and swift decision-making. This campaign was executed with the assistance of an external agency to ensure accuracy and impartiality. Based on the findings, appropriate training programmes for all service staff were conducted on:

- Customer Service Champions for all branch front line staff, covering “Professionalism in Customer Service and best practices in Customer Handling”.

- Call Centre Champions intended for Call Centre Staff (Including Recovery Call Centre) on “Professionalism in call handling”.

- Special training on Premier Customer Call Handling for Call Centre Premier Line dedicated staff covering “How to handle premier customer calls properly”.

- Training on Telephone etiquette is being conducted or branch staff, covering “Telephone Etiquette and best practices”.

Customer feedback for improving customer relationships

Customer feedback is of utmost importance as it provides valuable insights into customer satisfaction, preferences, and areas for improvement. It enables CDB to understand the needs and expectations of its customers, allowing them to make informed decisions and refine their products or services based on customer preferences. Customer feedback also helps in identifying potential issues or pain points, enabling prompt resolution and enhancing overall customer experience. By actively listening and responding to feedback, CDB is able to foster customer loyalty, drive innovation, and stay ahead in the competitive market.

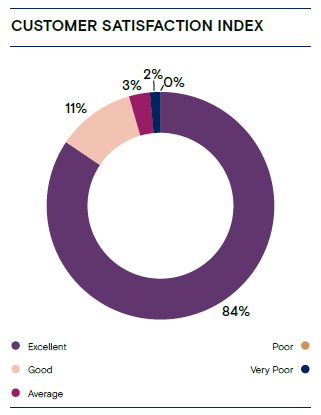

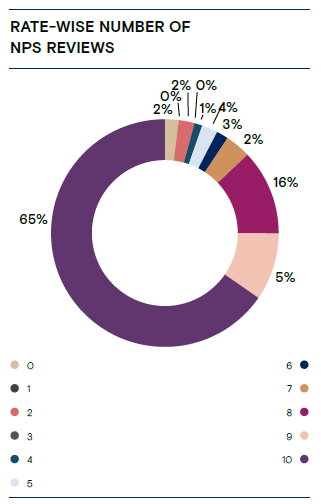

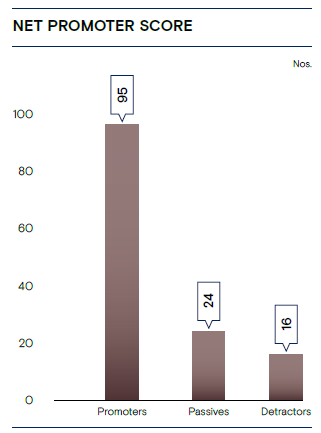

The contactless customer feedback process was successfully implemented in April 2023. This initiative was launched to assess customer satisfaction utilising the CSAT model and measure customer loyalty using the Net Promoter Score (NPS) model. The implementation of this process allows for efficient evaluation of customer feedback and provides valuable insights to enhance overall customer satisfaction and loyalty. However, since the initiative was launched recently, the feedback received is still in its early stages and has yet to gain momentum.

Changing the face of the post disbursement function

The post disbursement function in a financial services company is crucial to both customers and company. It ensures clients meet their financial commitments on time and provide assistance to clients to navigate through financial difficulties by providing assistance required. Simultaneously it is important for the organisation to minimise financial losses, manage cash flows and adhering to laws and regulations. It protects the organisation’s financial health, reputation, and stability by managing non-performing assets. Additionally, it provides valuable insights into customer behaviour and payment patterns, aiding in future lending decisions and credit risk management. An efficient recoveries function is vital for sustainable growth and risk mitigation.

CDB has enhanced the efficiency and effectiveness of its recovery process through the introduction of new digital apps. Automation of tasks, real-time progress tracking, and improved customer communication have enhanced the overall operational performance. These apps have also facilitated faster and more accurate data analysis, enabling the integration of emerging technologies into analytical processes. As a result, CDB has achieved improved recovery rates and elevated operational performance.

- Debt Recovery Management Systems, including the Smart Collect App (ERP), Recovery Follow-up BI Applications (Tableau), Credit Card Management System (Digiapp), and Disposal Deficit Management System (ERP) bring multiple benefits to CDB. These include enhanced asset quality, reduced recovery costs, improved collection process efficiency, streamlined customer visits, optimal HR utilisation, instant feedback, minimal customer complaints, strengthened risk management, and reduced risk premiums. These systems collectively contribute to CDB’s success by optimising operations, mitigating risks, and ensuring customer satisfaction.

- Default Waivers Management System results in improved operational efficiency, reduced manpower requirements, strengthened risk controls, and enhanced overdue interest and rebate on future interest management.

- Settlement Management System facilitates improved operational efficiency, reduced manpower requirements, strengthened risk controls, enhanced overdue interest and future interest rebate management, and reduced settlement time. It also enables customers to obtain documents faster and enhances service quality and transparency.

- Facility Rescheduling System improves operations efficiency, reduces manpower, improves risk control, and enhances overdue interest and future interest rebate management control whilst assuring speedy solutions and feedback to customers.

- Enabling mobile and online payment options (Pay & Go, eZ Cash/M Cash, other bank branches, supermarket outlets and CRMs) reduce branch traffic, supports CDB’s virtual concept, and eliminates the need for customers’ branch visits.

Ensuring compliance in a changing regulatory landscape

GRI 2-25, 417-2, 417-3, 418-1

Compliance is crucial for a financial services organisation to ensure adherence to regulatory requirements, legal standards, and ethical practices, in addition to mitigating legal and reputational risks, and protecting customers’ interests. Compliance frameworks promote transparency, accountability, and fair business practices. By complying with regulations, organisations build trust, credibility, and long-term relationships with customers. Compliance also fosters confidence of investors and other stakeholders, and contributes to sustainable growth in the highly regulated financial services industry.

The CDB customer charter ensures the protection of our customers’ rights. Throughout the review period, there were no instances of non-compliance with product and service labelling or marketing communication guidelines. Additionally, there were no incidents of non-compliance related to anti-competitive behaviour, anti-trust issues, or monopoly practices. Furthermore, there were no substantiated complaints regarding breaches of customer privacy or losses of customer data. No recorded incidents of non-compliance were found concerning the health and safety impacts of CDB’s products and services. The Company remain committed to upholding these standards and maintaining a high level of compliance in all areas affecting its customers.